Business Insurance in and around Oswego

Get your Oswego business covered, right here!

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Preparation is key for when a catastrophe happens on your business's property like a customer stumbling and falling.

Get your Oswego business covered, right here!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Janna Misek can not only help you design a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Don’t let fears about your business stress you out! Get in touch with State Farm agent Janna Misek today, and discover the advantages of State Farm small business insurance.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

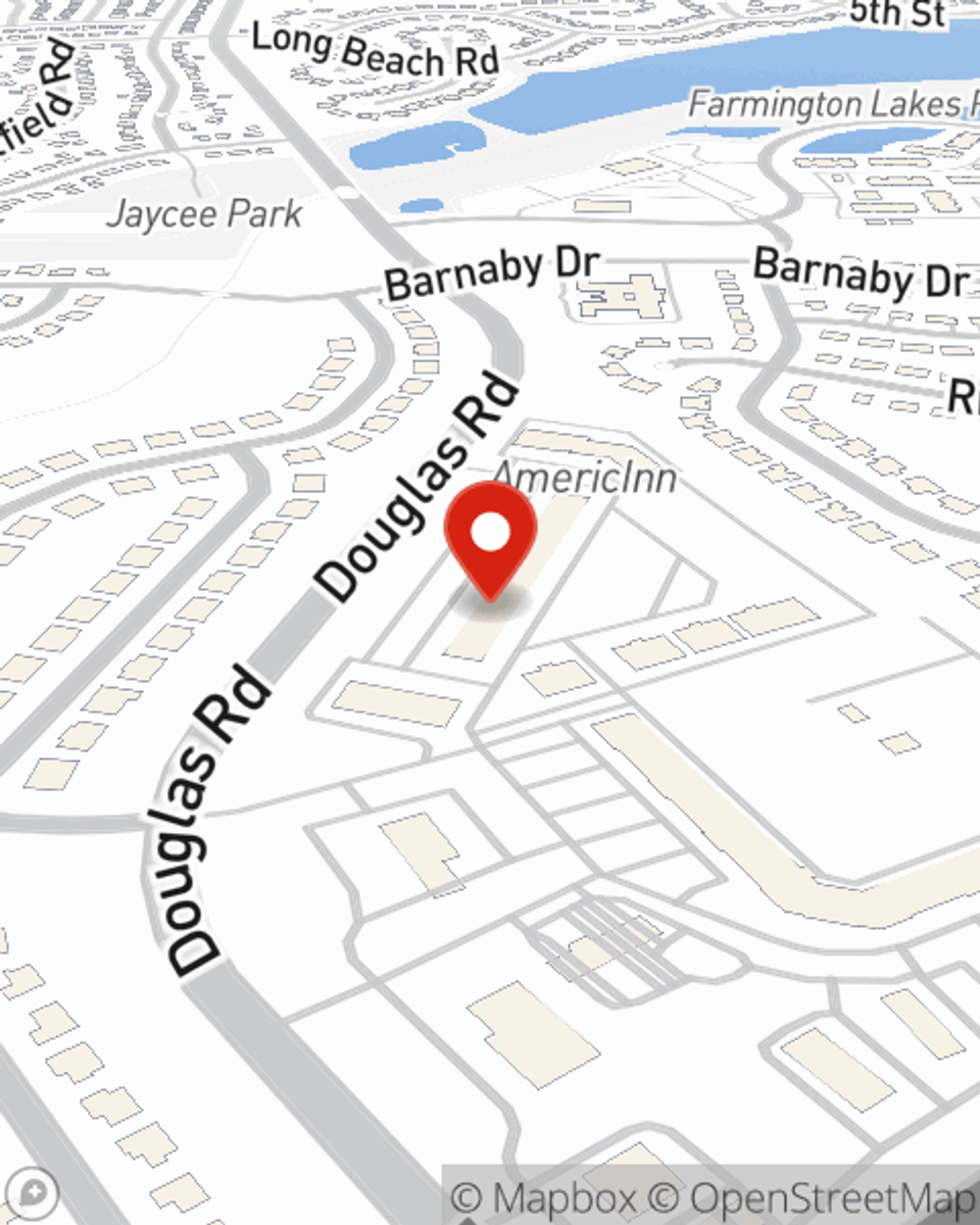

Janna Misek

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?