Homeowners Insurance in and around Oswego

Oswego, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

One of the most important steps you can take for your loved ones is to cover your home through State Farm. This way you can kick back knowing that your home is protected.

Oswego, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

From your home to your prized pictures, State Farm is here to make sure your valuables are covered. Janna Misek would love to help you know what insurance fits your needs.

Don’t let the unknown about your home make you unsettled! Call or email State Farm Agent Janna Misek today and see how you can meet your needs with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Janna at (630) 554-1540 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

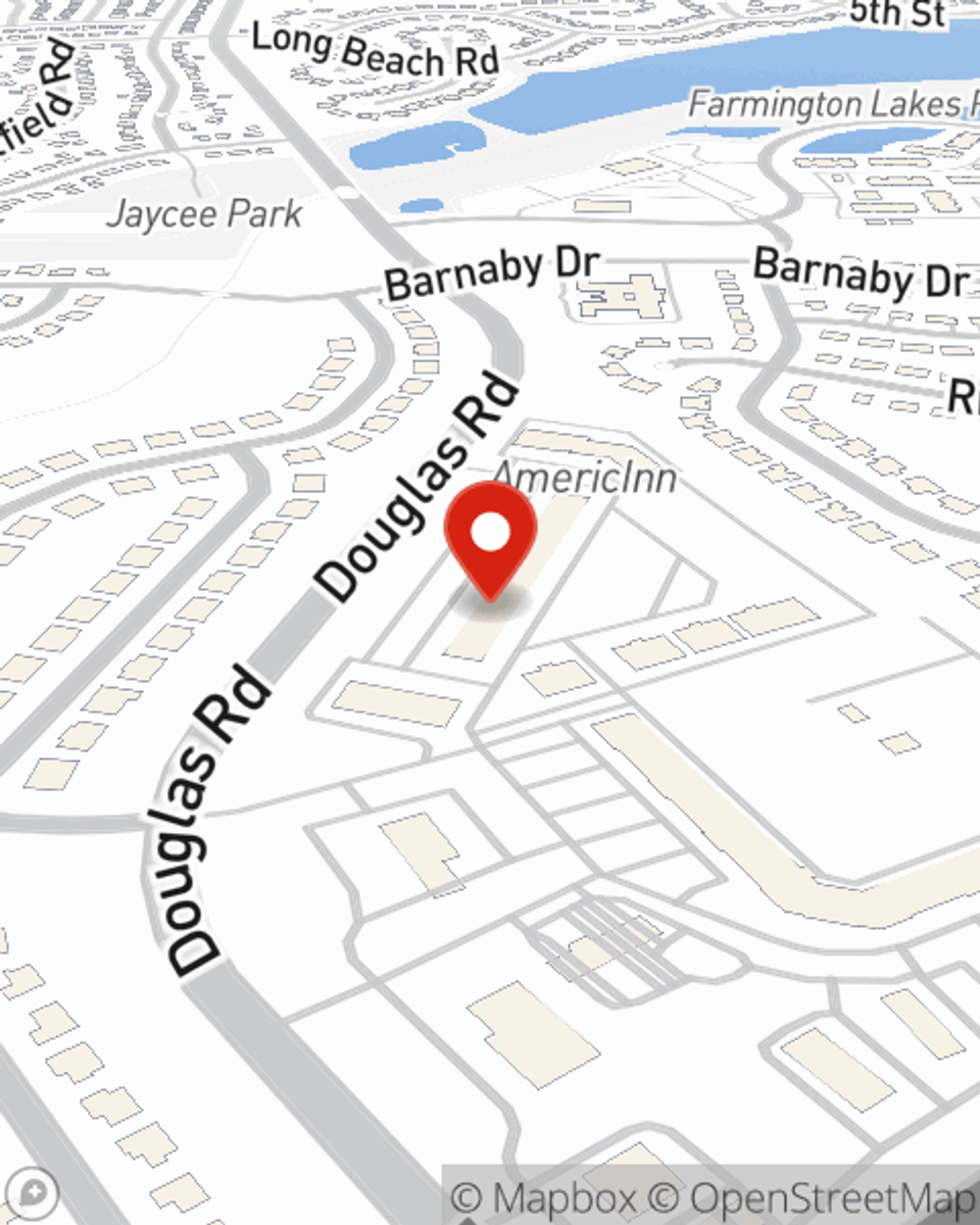

Janna Misek

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.